How to Run Payroll

A short walkthrough article that shows you the steps for running payroll for your employees.

Running payroll must be done manually and within an appropriate time frame based on your processing time.

We recommend you run payroll as early as possible for each pay period, but the default processing time is 4 days. This means payroll must be run 4 days before employees are meant to receive their pay checks.

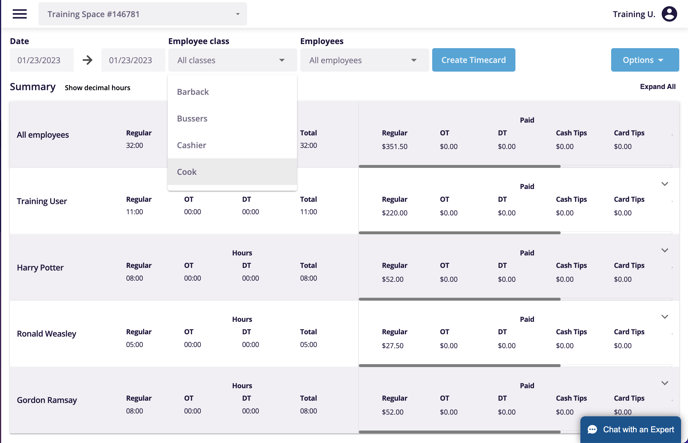

Before running payroll, you should review the Time Cards report for the pay period to ensure that all punches are accounted for and are accurate.

Running Payroll

To begin running payroll, click on Payroll, and then Run Payroll on the left hand side.

Now all you need to do is define the start and end date for the pay period, as well as the expected date employees should receive their paychecks. Click Create Payroll, and it will be added to the Previous Payrolls List as a submitted job.

After a few moments the status will be updated to Processing, where you can take a final review of your employees' expected pay. Click on Run to begin reviewing. This is also where you will need to update Tip information for the pay period.

This is also where you will need to update Tip information for the pay period.

Next to Paycheck Tips, enter the amount of tips that are paid to your employees directly on their paycheck. If no tips are given to your employees through their paychecks, enter $0.00

Next to Cash Tips, enter the amount of tips your employee has received in cash. This includes any credit card tips the employee is cashed out at the end of each shift. If the employee does not receive any tips in cash, enter $0.00.

Next to each of these numbers, be sure to account for any gratuity given to the employee, and tips that are shared with other team members through tip outs or tip pooling.

When you are finished making changes for each employee, click on Preview Payroll, and then Submit Payroll in the top right corner.

For any further support, please reach out to our 24/7 customer support team at 505-535-5288 or email support@lavu.com.